Every business faces risks that standard insurance may not fully cover. From lawsuits to accidents, the financial burden can sometimes exceed the limits of regular insurance policies. This is where umbrella insurance comes in. It provides businesses with an additional layer of security, ensuring they are protected from substantial liabilities.

Without this additional protection, a single unexpected incident could jeopardize the financial health of a business. Understanding how it works, umbrella insurance can empower business owners to make informed decisions about their coverage needs. This article will dive deep into what is umbrella insurance for business, what it covers, and how it can benefit different commercial purposes.

What Is Umbrella Insurance for Business?

Umbrella insurance is a type of excess liability insurance that provides extra coverage when the costs of a claim exceed the limits of existing business insurance policies. Unlike standard policies that offer specific coverage limits, umbrella insurance acts as a safety net for businesses, ensuring that they’re not financially exposed to catastrophic risks.

It’s important to understand that umbrella insurance doesn’t stand alone. It typically kicks in only after the base policy, like general liability or workers’ compensation, reaches its limit. For many businesses, this added layer of protection is crucial for safeguarding assets against unexpected, high-cost liabilities.

What Does Umbrella Insurance Cover?

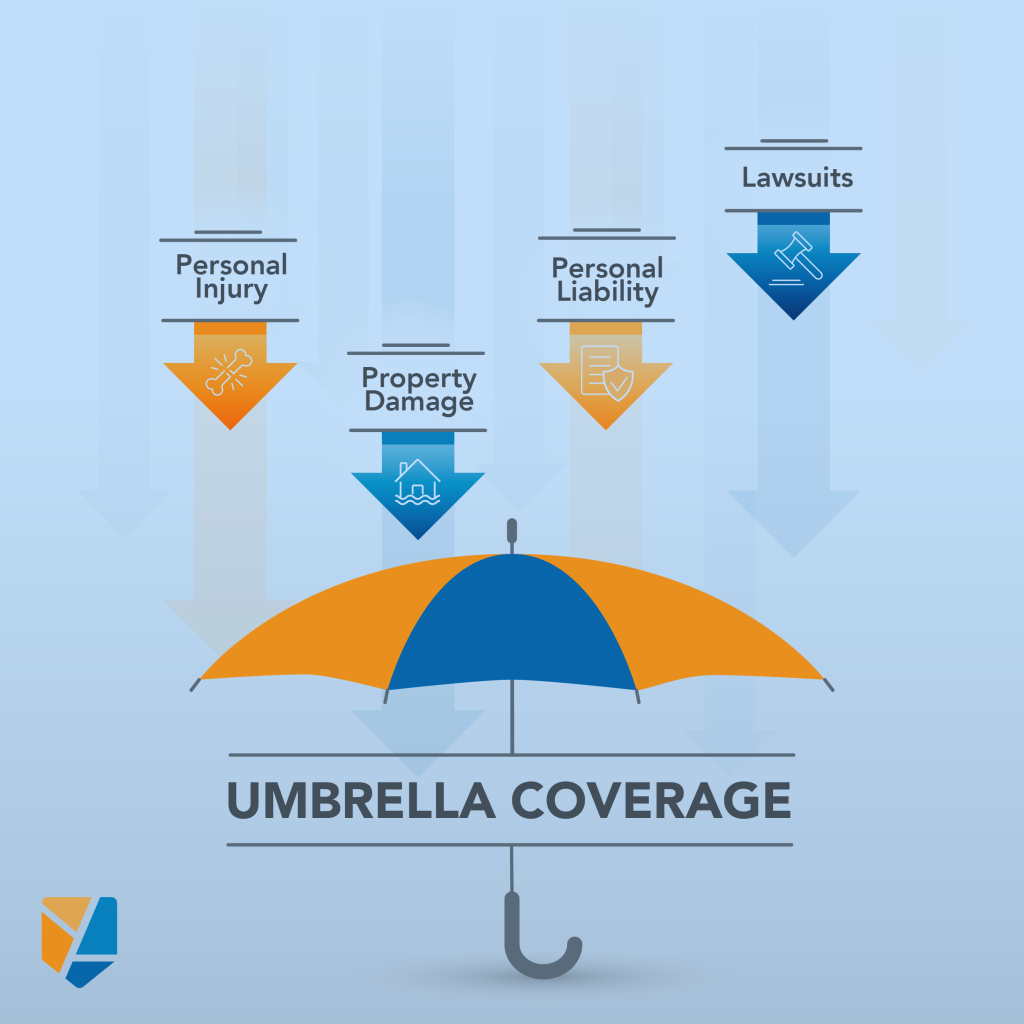

Umbrella insurance extends the coverage of existing policies and covers a broad range of claims, including:

- Third-party injuries – If a customer or client is injured on your business premises and your liability insurance maxes out, umbrella insurance covers the remaining costs.

- Property damage – If your business accidentally damages someone else’s property, and the claim exceeds your policy’s limits, umbrella insurance steps in.

- Legal defense costs – Litigation can be expensive. If your primary insurance can’t cover the legal fees, umbrella insurance helps manage those additional costs.

- Defamation and slander claims – In cases where your business is sued for defamation or slander, umbrella insurance provides protection if the lawsuit’s settlement exceeds the limits of your base policy.

Umbrella insurance is designed to offer a wide safety net but doesn’t cover everything. For example, it typically excludes liability related to professional services, employee injuries, or business-related intentional actions.

It’s also important to understand the relationship between umbrella insurance and existing coverage types, such as named perils coverage, which specifically lists covered risks. While named perils coverage protects against certain enumerated risks, umbrella insurance provides a broader layer of protection for unforeseen events.

How Umbrella Insurance Works

Umbrella insurance isn’t a standalone policy, meaning it’s designed to supplement other insurance policies. It works with your existing liability insurance policies like general liability, commercial auto, or employer’s liability. When a claim surpasses the limits of these primary policies, umbrella insurance steps in to cover the remaining costs.

For example, if a customer slips and falls at your office and files a $1 million lawsuit, but your general liability policy covers only $500,000, umbrella insurance can cover the excess amount. It’s this interaction with base policies that makes umbrella insurance an essential tool for businesses facing potential large claims.

Examples of When Businesses Might Need Umbrella Insurance

Now that you understand what is umbrella insurance for business, let’s explore some examples of when businesses might need this coverage.

Consider a retail business where a customer sustains serious injuries from a falling shelf. If the injured party files a lawsuit for $750,000, and the business’s general liability policy only covers $500,000, umbrella insurance would cover the additional $250,000. Without it, the business would have to pay the difference out-of-pocket.

Another example is in the construction industry, where high-risk activities often result in significant claims. If property damage or workplace accidents exceed the coverage of standard policies, umbrella insurance prevents the business from facing financial ruin. For instance, if a worker is injured on-site and the medical costs and legal fees surpass the limits of the general liability policy, umbrella insurance steps in to cover those additional expenses.

This added layer of protection is crucial in an industry with a high potential for costly claims, ensuring that a single incident does not impact the business’s financial situation.

Industries That Benefit Most from Umbrella Insurance

While umbrella insurance can benefit all types of businesses, some industries are more prone to higher risks and larger claims. Industries like construction, retail, and hospitality frequently face large lawsuits, making umbrella insurance an essential part of their risk management strategy.

Construction

The high-risk nature of construction projects makes this industry particularly vulnerable to costly claims related to property damage and employee injuries.

Retail

Slip-and-fall accidents, property damage, and defamation cases can lead to large settlements, especially in customer-facing environments.

Hospitality

With frequent public interactions, businesses in the hospitality sector are often exposed to liability risks that may exceed their primary insurance coverage.

In these industries, umbrella insurance ensures that businesses remain protected from extreme financial exposure.

The Costs of Umbrella Insurance for Businesses

The cost of umbrella insurance varies depending on several factors, such as the size of the business, the industry it operates in, and its overall risk exposure. For instance, a small business with low risks might pay significantly less than a large construction firm engaged in numerous high-risk projects.

Generally, premiums reflect the size of the business, with larger companies facing higher costs due to their increased exposure to potential claims. Additionally, businesses in high-risk industries, such as construction or hospitality, often encounter higher premiums because of their greater likelihood of liability claims.

The selected policy limits also play a crucial role in determining costs, as businesses opt for higher coverage limits, the premiums tend to increase. Businesses can choose from various coverage limits, ranging from $1 million to tens of millions, depending on their specific needs and risk profiles.

How Much Umbrella Insurance Does a Business Need?

Determining how much umbrella insurance a business needs depends on various factors, such as the size of the business, the assets at risk, and the industry it operates. It’s recommended to evaluate your primary insurance coverage and assess potential risks to understand how much excess liability coverage would be necessary.

For small businesses with fewer assets, a $1-2 million umbrella policy might suffice. However, for larger businesses in high-risk industries, policies with limits of $5 million or more may be appropriate. Consulting with an insurance agent can help tailor the right amount of coverage based on the specific risk profile of the business.

Conclusion

Now that you know what Is umbrella insurance for business, you know that this coverage is a vital part of a business’s risk management strategy, offering crucial protection against unforeseen liabilities that could result in significant financial loss.

By extending coverage beyond the limits of primary insurance policies, umbrella insurance helps safeguard companies from substantial risks that standard policies may not fully cover. In an unpredictable business environment, investing in umbrella insurance provides an additional safe layer of insurance, allowing business owners to focus on growth and success while knowing their assets are protected against unexpected challenges.